Welcome to the 2022 Sand Hill East End of Year review. What a year it was. For me, losing my Dad was a major surprise and reminds us that life is uncertain so best to prioritize your time around people and purposeful pursuits you really care about. We lost a number of other friends this year most recently John Russo from Merrill and Jim Younan from Merrill Lynch and UBS. We remember them fondly and wish their families all the best in 2023.

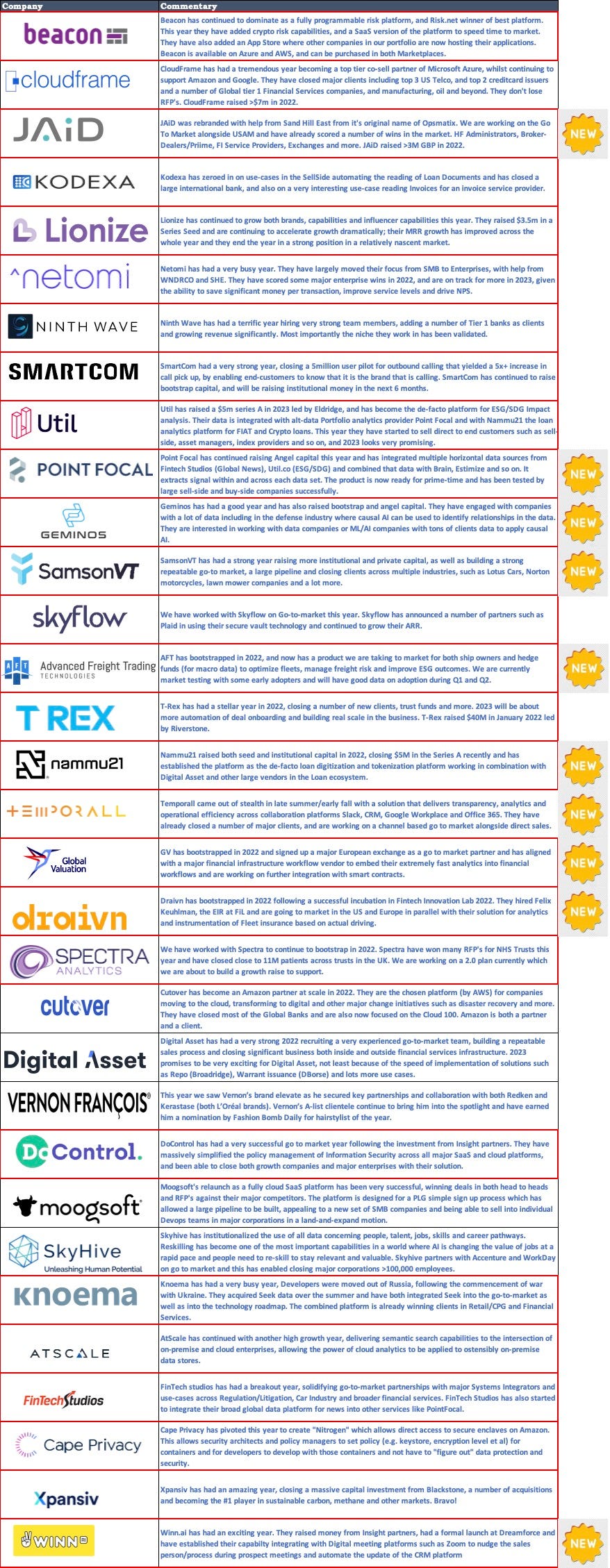

We have expanded our service offerings for Professional and Advisory Services and have spent a lot more time on Brand, Messaging, Marketing and the detail of Go-To-Market from a sales perspective, with particular focus on chasm crossing… We added a number of new companies this year and have continued to work with many of our companies that are now growth equity stage, as well as doing more work in the Enterprise FS world.

We added a number of new partners including Neil Chinai, John Bruno, Julie Lyle and Drew Rayman. They have brought significant additional skills and fire power to the capabilities we can accelerate with our portfolio companies.

We spent a lot of time nurturing opportunities with UK startups that are ready for the US market, or which will be in the next year or so and worked with a number of them to be prepared. The fruit of this labor will be realized in 2023 and 2024.

We also have a new website coming which will be launched early in the New Year that the team have spent a lot of time on. . Here is a sneak peak…

Our summer soirée this year was a super success, weather was luckily perfect, and we spent 4 high energy and impassioned discussion hours with clients, prospects, enterprise software people, startup founders and fintech ecosystem people.

Carrying on the theme our Christmas/Holiday party was also fantastic and both venues for summer and winter are keepers!

We know many people are going into the New Year with cost savings targets and many of our startups and investments are in a good position to help. We are publishing three articles on approaches to taking out cost in the next month or so.

Part I — For any kind of company (published 12/29/2022)

Part II — For Financial Services Companies (to be published)

Part III — For Insurance, Pharma and Healthcare Companies (to be published)

Below please find company updates for current clients and companies we are working with; all feedback is welcome, feel free to text or email.

Alumni

Diamond Standard had another very successful year closing funding and significantly advancing progress in bringing diamonds as a commodity to be easy for clients and customers to get exposure to.

Modelshop had a successful 2022 finishing cash positive and really finding a good niche for the platform. More market testing in 2023 to do, but on a good track.

Equiva has made strong progress this year moving from hospital use-case and extending to phone based home support. As many operations become same day (even hip surgery!!) this kind of instant digital access to your doctors and health providers will become more prevalent.

Investments

DeepFactor had a very successful year empowering engineering teams to fix vulnerabilities, supply chain risks, and compliance violations early in development and testing.

Ediphy has continued to develop solutions for FI Best Execution and is very involved in the consolidated tape initiative in Europe.

Verdigris worked hard in 2022, and against a tough market for energy consumption optimization in buildings, data centers and celltowers. They made significant progress product wise. 2023 will be very important.

Cyberhaven had a successful year under Howard Ting’s leadership growing significantly and cementing their position in next generation DLP.

Conceal had a great year under new leadership this year (pka Netabstraction and Cutting Edge). Conceal adds comprehensive malware protection to any browser. ConcealBrowse converts any browser into a secure browser, stopping ransomware and credential theft for good!

Capital Markets Gateway continued to build out their Capital Markets platform in 2022 hitting amazing scale with over 100 leading asset managers, with $20 trillion in assets under management.

Tornado has had a strong 2022 building significant market presence for their next generation personal wealth / trading platform and enabling it for white labeling.

One Creation with their privacy first platform has made good progress in 2022 in a market that is really just coming to into its own. It is clear that privacy will be more important going forward, and will play to OC’s strengths.

rtZen emerged this year into a private beta providing sophisticated cash solutions to CFO’s of earlier stage companies.

About Sand Hill East : www.sandhilleast.net

Email : info@sandhilleast.net Or send WhatsApp / iMessage to me. If you don’t have my phone number please dm me on LinkedIn.